Tax Planning Leigh - The Facts

Table of ContentsSome Known Details About Tax Planning Leigh The Basic Principles Of Tax Planning Leigh Things about Tax Planning LeighWhat Does Tax Planning Leigh Mean?The Best Guide To Tax Planning LeighThe Buzz on Tax Planning LeighSome Known Questions About Tax Planning Leigh.The Of Tax Planning Leigh

Both the proprietors and also employees of C firms get wages for their work, and the company needs to keep tax obligations on the wages paid. All such wages are tax obligation insurance deductible for the corporations, as are fringe benefits provided to workers. Lots of smaller firms can set up to pay all company income in incomes and also advantages, leaving no revenue subject to the company revenue tax.Still, companies can utilize tax obligation planning methods to delay or build up income in between the company as well as people in order to pay tax obligations in the lowest possible tax brace. The one significant downside to company tax is that company revenue is subject to business taxes, as well as after that revenue circulations to investors in the form of rewards are additionally taxable for the investors.

The Basic Principles Of Tax Planning Leigh

Specialists note that it is often preferable for tax obligation planning functions to begin a brand-new business as an S company rather than a C firm. Many companies reveal a loss for a year or even more when they initially begin procedures. At the same time, private owners often squander financial investments as well as offer possessions in order to gather the funds needed to begin the service (tax planning leigh).

One more tax planning technique offered to shareholder/employees of S companies includes maintaining FICA tax obligations reduced by setting small salaries on their own, listed below the Social Protection base. S corporation shareholder/employees are only needed to pay FICA tax obligations on the income that they receive as salaries, not on income that they get as dividends or on revenues that are preserved in the firm.

The Basic Principles Of Tax Planning Leigh

It is essential not to leave tax obligation planning to the last moment. Plan to invest in tax-savings instruments from the beginning of the financial year and also make use all the benefits to lower your tax payments. To reduce lawsuits: Minimising lawful litigations is crucial while preparing taxes. If you do not have one, you need to avail the solutions of a lawful consultant.

Minimising lawsuits saves you from judicial harassment. To secure the economic climate of the country: The tax obligations you pay are dedicated to the improvement of the country. If you pay all the taxes which are lawfully due, you can add in the direction of creating a much more effective economic situation. Planning your taxes is helpful for you as well as the economic climate of the nation in which you're living.

Tax Planning Leigh Things To Know Before You Get This

They are as under: Short-range tax obligation preparation: This is a term utilized of tax planning that is both, though of as well as carried out when the economic year concerns an end. Capitalists consider this preparation on the heels of completion of the monetary year, attempting to discover means to lower their tax responsibilities legitimately.

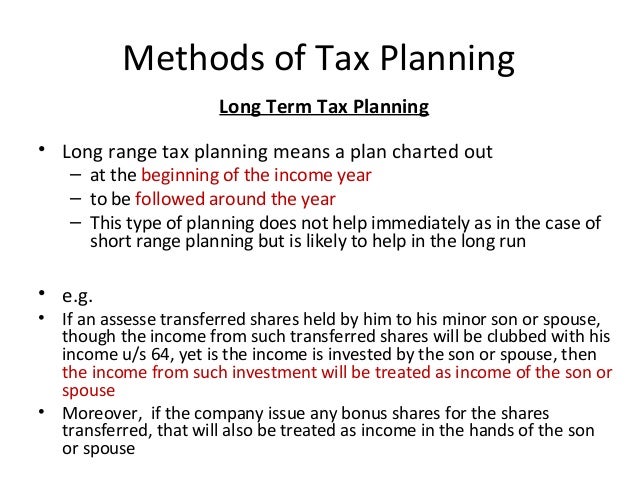

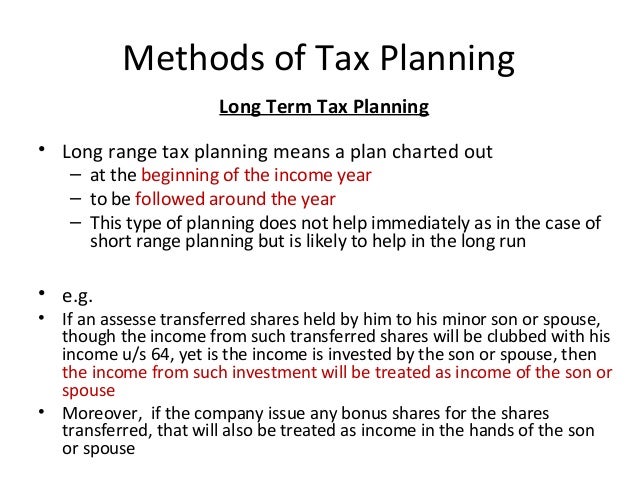

Assesses might be able to do that by properly arranging to get tax rebates under Area 88. Short-range tax obligation planning does not entail long-lasting dedications, while it still can advertise considerable tax savings. Long-range tax obligation planning: The long-range tax obligation plan is one chalked out when the financial year begins, as well as which the taxpayer complies with throughout the year.

5 Easy Facts About Tax Planning Leigh Explained

You typically need to start spending when the brand-new fiscal year starts as well as hang on to the investment for a duration going beyond one year. Permissive tax obligation preparation: Liberal tax obligation planning, as the term suggests, suggests intending investments under different arrangements of the taxes regulations of India. In India, there are several stipulations of legislation, supplying exemptions, reductions, motivations as well as payments.

The taxes we pay are utilized for the development of our nation. In a method, the tax obligations paid by us are made use of for our advantage. Based on our different revenue pieces, everybody pay a various percent of taxes, but the benefits are dispersed similarly among all Indian citizens alike.

Not known Details About Tax Planning Leigh

We discuss one of the most important actions just recently presented regarding compound as well as organization factor. One of the most vital development within the Mexican tax obligation system that might impact tax obligation planning is an idea that has been in place for a long period of time in various other territories, yet in Mexico is instead an uniqueness, developed by instance legislation: materiality.

Getting My Tax Planning Leigh To Work

This is particularly true in the situation of solutions, where there might be little or no proof of the human task worried, also if the result thereof might be physically recognised. If a service carrier fixings a provided piece of machinery, yet falls short to supply a malfunction report or a record of fixings done, there may be little or no proof at all that the equipment was, in truth, fixed, and also, for that reason, payment in exchange thereof may end up being non-deductible.

Appropriately, any type of purchase that has a tax obligation benefit (tax reduction, reduction, credit report, non-taxation, etc.) but does not have a service objective will certainly be given the tax obligation impacts that would certainly represent the legal purchases that would have been executed to acquire a 'reasonably anticipated economic advantage' by the taxpayer, which, obviously, have to be besides Read More Here a financial one.

Facts About Tax Planning Leigh Uncovered

However, this arrangement offers a number of challenges from an advising point ofview, consisting of the following: (1) there is no administrative or judicial experience with standards such as the 'organization factor'; (2) there is no assistance regarding what the kind of evidence would certainly be required to satisfy this standard; and also (3) the body explained over is likely to be made up of occupation officials with little or no experience in a service environment.